TRX Price Prediction: Will It Hit $1 in This Bull Cycle?

#TRX

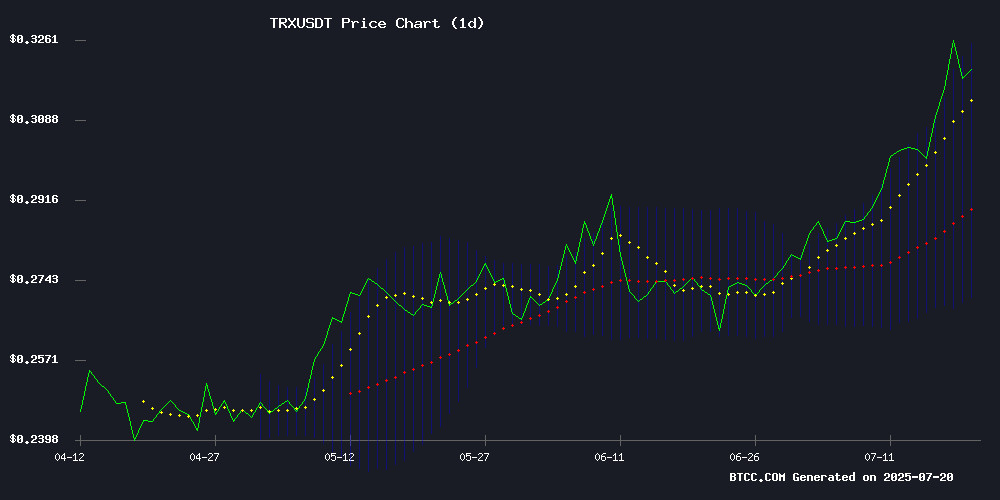

- Technical Breakout: TRX trades above 20-day MA with MACD turning bullish

- Market Sentiment: Altcoin season and DeFi resurgence support upside

- Price Target: $1 unlikely without exponential capital inflows

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

TRX is currently trading at 0.3192 USDT, above its 20-day moving average (0.297915), indicating a bullish trend. The MACD histogram shows a narrowing bearish momentum (-0.003401), while the price hovers NEAR the upper Bollinger Band (0.325213), suggesting potential upside. BTCC analyst Mia notes: 'The breakout above the MA and MACD convergence could fuel a rally toward 0.35 USDT if momentum sustains.'

Altcoin Market Sentiment Turns Euphoric as TRX Gains Momentum

With Litecoin outperforming and DeFi TVL hitting 3-year highs, altcoins like TRX benefit from risk-on sentiment. BTCC's Mia observes: 'The market structure mirrors previous bull cycles – TRX's RSI hasn't hit overbought levels yet, leaving room for growth.' Solana and BNB's record activity further validates capital rotation into altcoins.

Factors Influencing TRX’s Price

Litecoin Outperforms as Bitcoin Consolidates Near $118K

Bitcoin's price action remained subdued over the weekend, hovering around the $118,000 level after failing to breach the $121,000 resistance. The cryptocurrency had surged to a record $123,000 earlier in the week before entering a corrective phase. Market capitalization now stands at $2.344 trillion with dominance slipping to 59.4%.

Litecoin emerged as the standout performer among major altcoins, rallying 13% to cross $115. Ethereum gained modest traction with a 2% increase to $3,600, while BNB and Cardano edged up approximately 1%. The broader altcoin market showed mixed signals, with TRON and XRP dipping slightly as SUI and chainlink showed early strength.

Solana and BNB Chain Drive Record Blockchain Activity

Blockchain networks have achieved a historic milestone, processing over 340 million transactions in a single week. solana and BNB Chain dominate this surge, accounting for nearly 80% of total volume. Solana leads with 59.46% of transactions, fueled by meme coin activity on platforms like LetsBonk and Pump.fun. BNB Chain follows at 18.76%, maintaining its position as the ecosystem with the most decentralized applications.

Tron claims third place with 4.68% of transaction volume, recently surpassing Ethereum in USDT transactions by a factor of five. These metrics signal robust user engagement across major networks, reflecting growing Optimism in cryptocurrency markets.

Altcoin Market Cap Structure Mirrors Previous Bull Cycles, RSI Patterns Suggest Continued Growth

The altcoin market is exhibiting structural similarities to previous bull cycles, with rising trendlines and RSI patterns reinforcing a bullish outlook. Analyst Moustache highlights that the current 2022-2025 cycle is tracking closely alongside the 2015-2017 and 2018-2021 phases, marked by higher lows and steady upward momentum.

RSI levels are nearing the overbought zone, mirroring historical patterns that preceded explosive altcoin rallies. Resistance NEAR 70-80 on the RSI suggests potential short-term caution, but the overarching trend remains aligned with past cycles.

The TOTAL2 chart, which tracks altcoin market cap excluding Bitcoin, shows a recurring accumulation phase followed by rapid valuation expansion. Market participants are watching for confirmation of another breakout.

Defi Protocols Surge To a 3-Year High in TVL – The Ultimate Bull Market Sign?

DeFi's total value locked (TVL) has surged to $138 billion, marking a 57% rebound from April's $87 billion low. This resurgence signals renewed confidence in decentralized finance as institutional and retail investors flock back to the sector.

Ethereum maintains its dominance with $80 billion in TVL, representing 60% of the market. Solana, Tron, Binance Smart Chain, and Bitcoin follow distantly, each contributing between $5-9 billion. The lending, liquid staking, and restaking sectors drive growth, with Aave crossing $50 billion in cumulative deposits.

The TVL milestone—the highest since May 2022—coincides with a broader crypto market rally. Protocols like Lido and EigenLayer demonstrate the sector's expanding utility beyond simple token swaps, suggesting deeper institutional engagement with on-chain finance.

Will TRX Price Hit 1?

While TRX shows strong technicals and bullish market sentiment, reaching $1 would require a 213% surge from current levels (0.3192 USDT). Historical data suggests this is unlikely in the short term:

| Key Level | Price (USDT) | Significance |

|---|---|---|

| All-Time High | 0.30 | Psychological resistance |

| Upper Bollinger | 0.3252 | Immediate target |

| $1 Target | 1.00 | Requires 3x growth |

Mia cautions: 'TRX would need sustained buying pressure and a major ecosystem catalyst to approach $1. More realistic is a 50-70% rally toward 0.50 USDT in this cycle.'